AI is transforming how several industries handle finance by automating manual tasks and making small decisions at scale. In lending, AI is mostly affecting the way underwriting decisions are made at scale, but it’s also impacting loan servicing and customer service.

Here, we’ll cover the essential topics around AI in lending and how its future is shaping up.

- What AI in lending is, and why it’s commonly used in underwriting

- How much trust lenders are giving AI to make decisions for them

- Common problems with AI in lending

- The ideal future state (and how it addresses those common problems)

What is AI lending, and how is it commonly used?

Artificial intelligence (AI) in lending is most commonly used to understand user-provided data better and make lending decisions faster.

For example, AI can quickly categorize transactions from a bank statement or API-linked bank account into different expenses and incomes that lenders need to evaluate. It can also summarize borrower bank statements and business plans to highlight the crucial data for loan decision-making.

Predicting risk

AI also predicts risk that isn’t immediately obvious by discovering hidden variables. Variables that would take a human several hours to find while pouring over bank transactions manually.

This is also true for loan servicing, which can use loan portfolio data to identify risks with specific customers or within the industry and recommend ways to address them.

Currently, lending AI mainly empowers data scientists in the banking industry to improve their efficiency in the credit decisioning process. However, it can also help lenders identify risks in loan servicing and even help with customer service through AI chatbots.

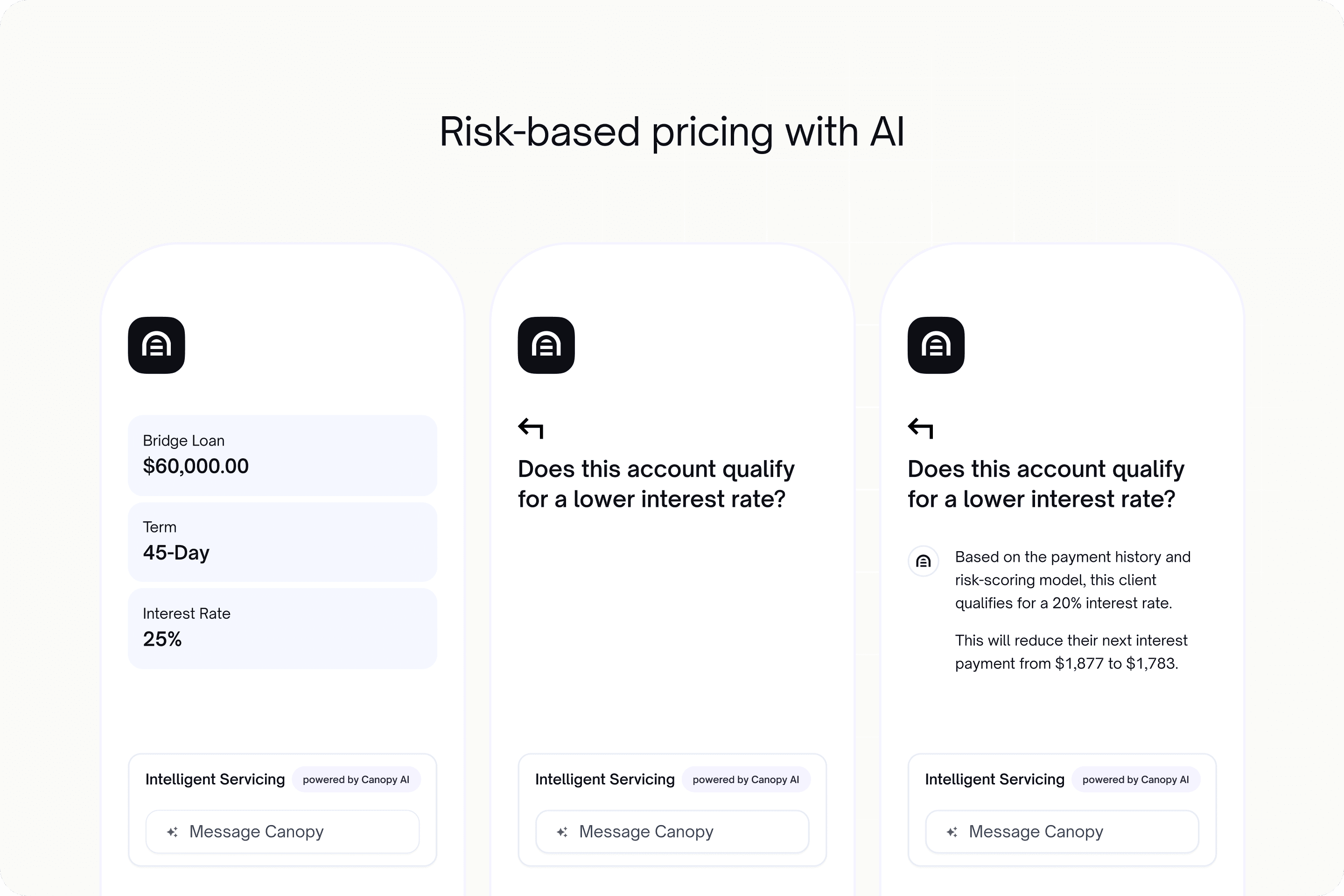

One example is risk-based pricing, where a lender can customize a loan’s interest and fee structure based on their credit risk models.

How much trust are lenders giving to AI? Is it making lending decisions on its own?

While companies give AI much power to interpret data, score it, and make suggestions, most lenders still don’t trust AI to make their final lending decisions.

AI-based lending models still have some issues (more on this below) that make them not trustworthy enough on their own. Plus, AI’s decisions without human intervention might not be easily explained for regulatory purposes or legal disputes.

Automating the entire lending process with AI may soon be possible, especially for small-dollar consumer or small-business loans. For now though, most companies choose to protect themselves by ensuring a human underwriter is still involved—supplementing with non-AI formulas and rules-based decision engines.

There are some interesting developments regarding lower-stakes decision-making in managing loans. More on this below.

Common problems with AI in lending

There are three main reasons that lenders still don’t fully trust AI to automate their lending decisions and choose to keep humans in the loop.

1. Legibility and reproducibility

In lending AI, legibility is why a credit scoring model settles on a particular loan decision. However, it’s difficult or impossible to determine legibility with AI, as the AI isn’t easily able to explain why or how it came to its decision.

Reproducibility means making the same decision each time when given the same data and parameters. AI has also struggled to reproduce the same lending decisions with the same data, and due to the legibility issue, it’s often unable to explain why.

Given these issues, it would be hard to explain to a customer or a regulator why a decision was made or if it would be made again given the same loan application. This is one of the main reasons a human underwriter still needs to be involved.

2. Fairness

With the lack of legibility comes an inherent lack of fairness. Without knowing why an AI model made a loan decision, it’s challenging to ensure it’s fair. This could be due to sources of unfairness fed into the model’s source data. For instance, if training data lacks representation from minority-owned businesses, the model may fail to make fair and accurate predictions for them. Ergo, it may not perform well when making decisions about underrepresented groups because it lacks sufficient examples to learn from.

3. Third-party risk

Third-party vendors, such as Provenir or Zest AI manage many lender AI models today. Both use machine learning to improve their models with a vast amount of data gathered over time, but this also introduces risk for the lender. For instance, the vendor could change something on the back end or source data that breaks the lending model. Backtesting results becomes more complicated in this scenario, further affecting problem number one, legibility and reproducibility.

Beyond underwriting: lending AI for loan servicing and customer service

Lending AI isn’t just for underwriting. It also has valuable use cases in loan servicing and customer service.

AI for loan servicing

AI can be used to monitor your loan portfolio to identify the right customers who might benefit from additional lending products or those who are struggling and might need extra support. This can result in higher lending revenue and lower customer acquisition costs, but it can also help your bottom line by increasing repayment rates.

Part of intelligent servicing is offering customers a helping hand to get through hard times. This might mean forgiving or delaying a payment, temporarily reducing rates, or restructuring a loan for a longer term.

AI can automatically identify struggling customers—such as those in a disaster zone—and devise a flexible loan management solution (which you would probably still want to run by a human before offering to customers).

Canopy loan servicing customers who implement flexible solutions like these increase repayment rates by an average of 30%. This means a healthier portfolio, happier customers, and a better long-term business.

AI for lending customer service

Like many industries, AI chatbots can also address customer service questions during both origination and servicing. AI is well-equipped to understand a borrower’s unique situation, so it could potentially answer detailed questions faster and with the needed depth. It could also be used to create “self-serve” customer service tools that answer the most common questions quickly and easily.

Examples of AI lending platforms

Here are some examples of lending companies that offer AI-enabled products today.

Prime

Prime is an embedded lending solution that empowers platforms to offer credit products to their small business customers. It provides the capital, infrastructure, and experience they need to get these embedded lending products shipped. Prime applies data science and AI technology to better evaluate loan applications in pre-qualification and underwriting. The result is higher approval rates and more customized solutions.

Stratyfy

Stratyfy is a loan decisioning partner to financial institutions. It uses interpretable AI solutions to reduce risk while increasing growth. It can help community lenders, regional banks, and fintech companies reach more customers, expand access to fairly priced credit, and enhance the credit decisioning process.

Upstart

Upstart is an all-digital lending platform that’s powered by AI. It helps banks and credit unions digitize their lending process for consumers (but not businesses) and deliver a modernized customer experience in both personal and auto lending. Upstart’s AI-based credit decisioning model provides instant credit decisions based on a financial institution’s policies and objectives.

While it is unclear if a human needs to be involved in the credit decision process, it seems that Upstart uses fully automated decisioning for a large percentage of small-dollar consumer loans.

Canopy

While not technically AI (at least not yet), Canopy offers an intelligent way to manage your loan portfolio. It allows you to connect with AI underwriting and other platforms to create an operating system for your loan business, where all customer loan accounts can be managed in one place.

It also enables intelligent servicing, which creates flexible servicing terms based on pre-determined workflows and conditions. These flexible loan capabilities create an average repayment rate increase of 30%.

What does the future of AI in lending look like?

The ideal future state of AI is one in which lenders can unlock its full potential while reducing risks. That means issues like legibility, reproducibility, and fairness have been solved, so fully automated processes can happen without human intervention.

For underwriting, it means fully automating the end-to-end loan application process, which will dramatically increase decision-making speed. It will also reduce operational costs, remove manual errors, and improve the customer experience (by decreasing wait times).

This means fully automated predictive loan servicing. Actions like adjusting loan payment plans or offering a one-month deferral could happen without human intervention. Ideally, portfolio health and repayment rates would rise significantly. If this flexibility becomes automated at scale, entire industries could be kept healthier through shared hard times.

On the lending industry side, AI should help more companies launch new products with fewer people and lower costs. Fintechs can enrich borrower data with AI tools to create compelling products.

According to Jarrod Parker, Head of Data at Prime (mentioned above), “the ideal state of AI in underwriting is one where we can reap the full benefits of the advanced capabilities with higher accuracy while fully mitigating the consequences.”

Create an intelligent lending program

At Canopy, we can help you create a lending program that uses our AI-enabled underwriting partners to make better and faster loan decisions while also using our servicing platform to better serve customers and increase repayment rates. We specialize in helping SaaS providers offering lending products, fintech, and neobanks like Mercury and Novo.