There has been a palpable shift in the world of fintech. From consumer lending products to B2B loans, merchants are taking hold of an opportunity to shake up the archaic payment ecosystem.

One area of expansion that fintech experts keenly have their eye on is embedded lending.

With embedded lending, borrowers can access loan products directly within the platform or app they’re already using and get approved quickly. It also makes it simple to get a loan without going through a financial institution and reduces service costs (win-win).

It’s not difficult to imagine why embedded lending is preferable to both merchants and consumers.

As Alex Johnson of Fintech Takes writes, lending is the perfect product category for embedded finance. After all, a loan exists to get consumers and businesses what they need, when they need it. Anything merchants can reduce their customers’ efforts to get a loan is immensely valuable.

One of the most popular examples of embedded lending for merchants is Buy Now Pay Later (BNPL). Widely used for consumer lending, BNPL offers short-term financing to buyers at the point of sale using split payments. With BNPL, a third party lender pays the merchant instantly, as the borrower pays off the loan over time. The loan lifecycle is typically broken into a 30, 60, or 90-day window.

For merchants that choose to offer BNPL or another lending product, it’s critical to also consider the right loan management system (LMS) to support it. A modern lending structure should make it just as easy on your borrower to pay back the loan as it was to get it. At the same time, the borrower should be able to get simple answers about the loan itself on their own time.

Another innovative example is a lending marketplace like Upstart that offers personal loans for major projects such as home improvement. Through this loan origination process, the borrower skips the application and wait associated with a traditional banking loan. Instead, they check their rate, choose the plan they want, and get funded. In fact, 99% of the time, applicants are approved and get the cash needed within one day.

Since 2020, embedded lending has become increasingly popular for several reasons.

By offering a modern lending product, merchants can provide their customers with a seamless and more convenient experience. Embedded lending can also help increase the accessibility of financial services, particularly for underserved or unbanked populations.

-

Convenience. Embedded lending allows customers to access credit or financing without having to leave whatever platform or application they are using. This makes it easier for customers to access funding, which can drive higher adoption rates of lending products for merchants.

-

Improved customer experience. Loan servicing is oftentimes a clunky experience for the end borrower. Embedded lending done right can open a new door for merchants to create value for their customers with personalized, transparent experiences.

-

Data-driven decision making. Through embedded lending, merchants can use advanced technology and analytics to make more informed decisions. For instance, companies can automatically analyze spending patterns and credit history during the loan origination process. This can reduce risk by offering the right interest rates and terms.

How embedded financing creates new revenue streams

As embedded lending gains popularity, the competition is increasing fast. According to new research by OneSpan and Smart Communications on the global lending industry, “93% of executives believe a smooth and effortless loan application experience is a survival factor.”

New players are also quickly entering the BNPL market, such as WooCommerce’s new Kriya Payments plugin at point of sale. Merchants who partner with point of sale lenders may see an increase in the average order size or checkout rate. This is especially true for high-ticket items, such as travel and auto purchases. At the same time, existing lenders are racing to expand their offerings.

This healthy competition seems to point toward more diverse, digital-first lending products on the horizon. It also means stricter regulations for lenders to follow, and reason to be intentional and fair in their offerings.

Here are a few embedded lending services to keep an eye on in 2023:

Traditional Financial Institutions Established banks and financial institutions may offer their own embedded lending products or partner with fintechs to expand.

Installment Payment Plans There are a growing number of Buy Now Pay Later third-party lenders embedded in the point of sale experience. The most popular BNPL marketplaces have been Affirm, Klarna, and Afterpay.

Big Tech Companies A few of the largest tech companies, such as Apple, Amazon, Facebook, and Google have also entered the arena, now offering their own embedded lending products. This expansion leverages their massive user bases and technology capabilities.

Industry Specific Providers Some lending products are specific to certain industries. One common example is invoice factoring for trucking business owners. In this case, the specialty lender may expand its offerings to include fuel cards or equipment leasing.

Conclusion

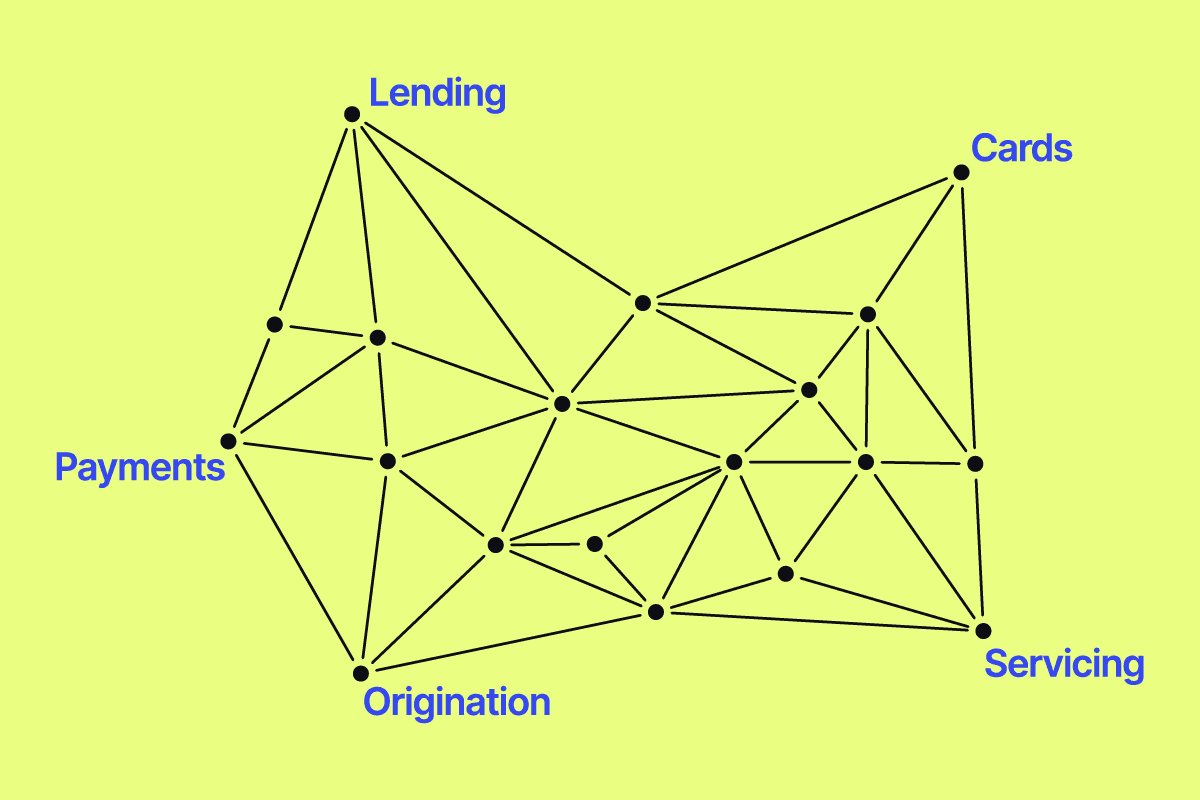

As the lending ecosystem expands, merchants and challenger banks have a unique opportunity to seize the moment. Bain & Company predicts the US market for embedded finance to surge from $2.6 to $7 trillion. Within this figure, payments and lending are expected to be the largest embedded financial service. For those building lending products, see how Canopy can help.