If you’ve been keeping an eye on the fintech space, you’ve likely heard about the FedNow rollout in August 2023. In the latest edition of our LinkedIn newsletter, The Lending Innovator by Canopy Founder & CEO Matt Bivons, we dove into this new payment rail and who it impacts the most.

Celebrating FedNow as the next step in payments

Paying gig workers in near real-time, sending refunds automatically once approved, funding loans instantly, and the list of benefits from FedNow goes on.

If you look under the surface though, something that all of these methods of payments have in common is that they require “push” payments rather than “pull.” More on why this matters in a moment.

While we should celebrate this as a win for the payments space, it remains unclear on how FedNow will vastly, if at all, help SMBs to get paid faster. To better understand why those in commercial lending won’t see much of an impact from FedNow with this initial rollout, let’s dive into push vs pull.

Push vs Pull Payments: How the difference affects SMBs

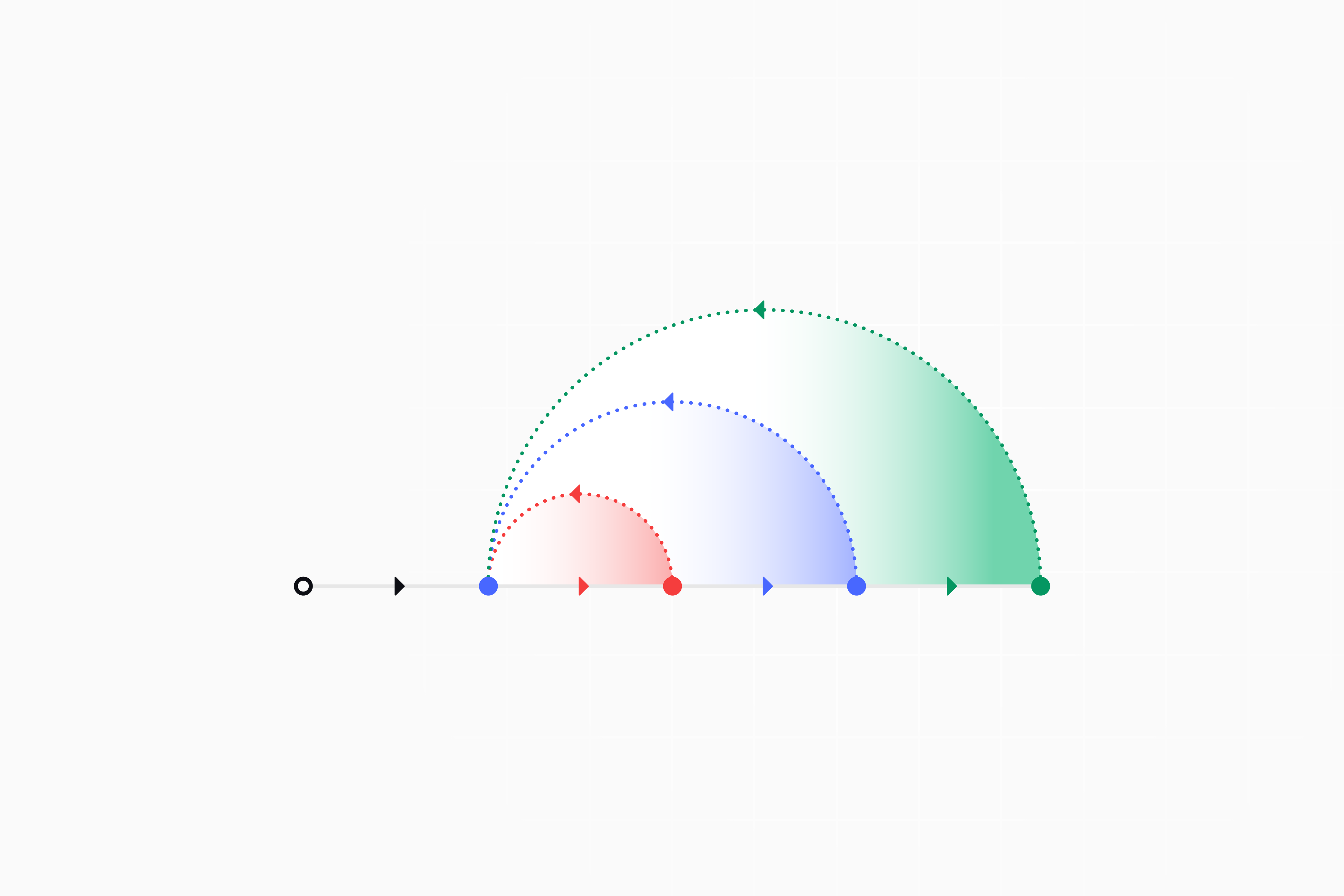

Push and pull payments refer to different methods of initiating and completing payments between parties.

Push payments are transactions where the sender (payer) initiates and pushes funds directly to the recipient’s (payee’s) account.

The sender takes the initiative to send money from their account to the payee’s account. Push payments offer more control to the payer, as they initiate the transaction. Examples include bank transfers, peer-to-peer payments (think Zelle or Venmo), and loan disbursements.

Pull payments, on the other hand, are where the payee is initiating the transaction of “pulling” funds from the payer’s account. This offers convenience for recurring payments, but requires the payer to authorize the payee to initiate the transaction. Examples include direct debits, preauthorized payments, and standing orders.

ACH vs. RTP vs. FedNow

Now that we have that out of the way, let’s look at how ACH, RTP and FedNow work.

One thing you’ll immediately notice is that only ACH is bi-directional, offering both push and pull payments. Both RTP and FedNow only offer push payments. However, they are also the only two that operate in real time. ACH is subject to banking hours and can take much longer to push or pull funds.

SMBs left behind

While another real time payment method isn’t a negative, FedNow leaves a lot to be desired if you’re a small business. Take a trucking company or a gym, for instance. Both of these businesses have hundreds, if not thousands, of receivables in any given month.

For the time being, FedNow requires manually making a FedNow request for each payment. When you have that many transactions being processed, it’s far too time consuming to have to go through each individually.

At the same time, while the person or company receiving the FedNow funds obviously loves getting the money as soon as possible, the other side of the transaction would rather take as long as they can to send the funds.

Looking ahead

The benefits and promise of “instant” is a step in the right direction. But it’s unclear if instant pull payments will ever be feasible in the SMB space.

Imagine someone being able to withdraw funds without you initially sending it to them. Great for the receiver, terrifying for the sender (and a whole host of fraud implications).

For the time being, working capital lending clearly still has a leg up. SMBs still have cash flow gaps to fill, but FedNow is not quite fitting in that hole yet.