Investments in digital lending have grown lopsided. Since 2020, we’ve seen significant upgrades in account opening and origination technology, while servicing and collections have remained largely untouched.

Soon, digital lenders will have to close this loop or risk losing long-term borrowers to a subpar customer experience. This is becoming more urgent as the digital lending market size is expected to double from its former $10.7 billion valuation in 2021 to $20.5 billion by 2026.

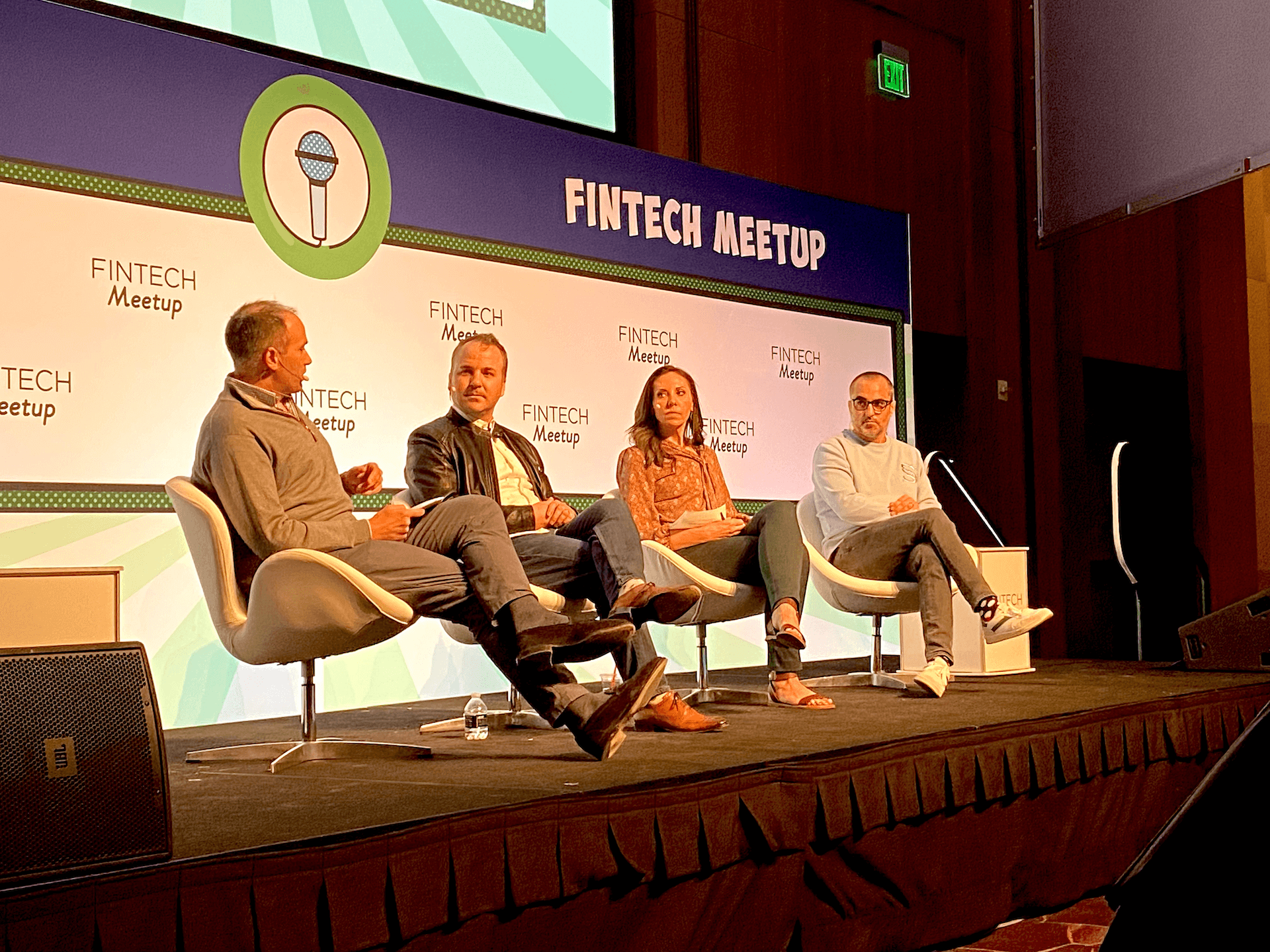

At Fintech Meetup 2023, Matt Bivons, CEO of Canopy, shared the stage with Ohad Samet of TrueML and Katrina Holt of Affirm to discuss why investments in digital loan servicing and collections can yield significant benefits.

90% of the loan lifecycle and engagement happens post-origination

Obtaining a loan is only the first step in digital lending. The entire experience post-loan origination through charge off or collections goes much deeper, and it has a real impact on borrowers’ lives.

According to a post-pandemic survey by Salesforce, two-thirds of consumers say they expect their banks to understand their unique needs and expectations. Yet, only 27% of those same respondents felt the financial services industry provides great service and support. This presents a massive opportunity for fintechs to stand out by offering hyper-personalized loan management servicing, and it seems this natural evolution of digital lending is only beginning.

Aside from competitive pressure to invest in loan management software, another top reason fintech buyers are answering the call for better loan servicing is productivity.

From spreadsheets to big banking cores

Lenders have historically had few options to service their customers in a productive manner. From automated call trees to delayed back office reporting and record management done within spreadsheets, it’s no wonder that borrowers are frustrated with traditional loan servicing.

In order to scale, lenders have had limited options. Large banking cores like TSYS, Fiserv, FIS, and Jack Henry allow for automated payment processing, but the costs can be unsustainable for new fintechs and retail card issuers. On top of pricing, large banking cores are oftentimes inflexible to addressing edge cases.

Another route some lenders have taken is to build an in-house loan management system. While this gives more freedom to innovate, an LMS is costly and time-intensive to manage. It’s also prone to human error as lending calculations become complex with personalization, making it difficult to scale or pivot a product offering.

How a modern lending core helps lenders become better operators

By surfacing loan data in a straightforward portal for team members and borrowers, operators are in a much better position to make smarter, real-time decisions.

Specifically, lenders can use a flexible lending core to recoup their payments, lower delinquency rates through automation and communication, iterate to understand what’s going on with their customers in real-time, and help service reps answer simple questions.

Building a comprehensive loan management service into the lending product can also decrease the cost of service (COS) over a borrower’s loan lifecycle.

A modern lending core is meant to provide transparent answers to common questions around topics such as:

-

Activating or editing borrower information

-

Requests to change terms within their credit line, APR, or fees

-

Help with or disputes on individual transactions

-

Submitting fraudulent claims or complaints

What are the challenges of servicing delinquent borrowers?

After three years of low delinquencies, during which the US government stepped in to boost consumer cash and spending, we’re seeing a trend back to baseline for credit and ecommerce.

This is also true for delinquencies. More Americans are falling behind in 2023 and need help making their loan payments. According to a study by Transunion, “2.1% of people who own a credit card are behind on their payments; this number will rise to 2.6% by the end of 2023.”

At the same time, the cost of the workforce to meet this demand is increasing. One way that lenders are combating this double-edged sword issue and working to increase their payback rate is through machine learning and automation.

As Ohad Samet, Co-Founder & CEO of TrueML noted, there’s a shift happening toward digital that’s changing the collections and recoveries landscape.

Ten years ago, only call centers existed for collections and servicing. Now, fintechs like TrueML are redefining the debt collection process by recognizing consumers’ unique needs and working with them to ensure they don’t become locked out of the financial system due to a period of financial distress.

How consumer purchasing behavior is changing digital lending

Most financial lending products have historically been commodities. A three-year loan offered by Wells Fargo doesn’t look much different than that of Bank of America, SoFi, or Earnest.

Meanwhile, consumer and business borrowers have made it clear that they want personalized, transparent loan alternatives. Challenger banks and fintechs have answered this call and set out to create a better borrower experience with embedded lending, automated onboarding, and a variety of lending repayment options based on AI models.

At the same time, many innovative lenders are still churning out the same servicing products. It’s only natural to balance the scales with a borrower experience that matches the loan origination next.

So, what do the next ten years look like in credit and lending?

Flexible, personalized infrastructure. For lenders to be competitive with the products they offer, they should invest in a flexible infrastructure. Presently, when someone is denied a three-year loan, they’re typically bumped up to the next tier (e.g., a seven-year loan). Rather than bucket borrowers into rigid plans, lenders should use a lending core that allows them to personalize their offering.

Empowering borrowers to make better decisions. Secondly, customer care or digital service agents should be able to answer table stakes questions for business and consumer borrowers. Then, they should go beyond those basics with ways to help their customers.

Canopy was born from CEO Matt Bivons’ experience in going delinquent with a Capital One credit card because he thought he’d paid it off, only to find that he’d paid the mid-statement amount, and fees were accumulating. Lenders should be able to easily address borrowers’ basic questions and help them make the best decisions for themselves.

-

What is my total payoff amount?

-

What if I were to overpay this month?

-

What does that do to my interest rate?

-

What does that do to my portfolio?

-

What does that do for me as a consumer?

These are the types of questions lenders should strive to answer to empower both customers and themselves as operators.

Built in compliance. As a record number of fintechs and challenger banks enter the space, regulations will likely continue to intensify. At this time, BNPL companies are largely unregulated even as the sector nearly quadrupled from March 2020 to March 2023 (Reuters). The recent collapse of two major banks, Silicon Valley Bank and Signature Bank in one weekend have drawn widespread scrutiny and calls for state regulators to step up.

Those building innovative credit and lending products that go beyond what traditional banks offer should not overlook the importance of having a lending core with built-in compliance.

Shifting from traditional banking to fintech

It’s unlikely that brick-and-mortar banks are going away anytime soon. However, many leaders in the banking space are bullish about the opportunity to improve the customer experience.

As Katrina Holt, Senior Vice President Operations at Affirm noted on-stage at Fintech Meetup, “There’s a reason why banking was seen as a commodity and why there hasn’t been disruption for a long time. Because it worked; it just didn’t work for consumers.”

When looking at the relentless shift in customer preference toward digital banking and embedded finance, it’s clear that we’re just beginning to see the real shift into digital lending.

Unlock lending innovation. Build on Canopy.

Building a credit, debit, or next-gen lending product? See how Canopy’s API-first platform can help you dramatically cut your time to launch new lending products. Learn more.