Table of contents:

- What is embedded lending, and what is the opportunity?

- Why SaaS companies are perfect for embedded lending

- Real-world embedded lending examples

- Types of embedded lending and how to offer them

SaaS companies have a special relationship with their customers. Whether a barbershop booking platform or a payment processor for e-commerce companies, they all have high-quality data that can better serve clients.

Embedded lending allows SaaS companies to leverage data that only they can access to create unique financial products. They can help customers expand to new locations, hire more employees, or cover costs during hard times. Embedded lending services enable customers and the industry as a whole to thrive.

Embedded finance lending is a unique opportunity to help SaaS companies increase revenues and strengthen customer relationships. Below, we’ll explain how embedded lending works, why SaaS companies are perfect for it, and how to get started.

What is embedded lending, and what is the opportunity?

Embedded lending refers to when nonfinancial companies integrate lending into their product portfolio. Instead of going to a bank for extra capital to cover expenses, a customer could go to one of their software vendors, which offers embedded lending for potentially better terms.

The embedded lending market size is already $6.35B and is expected to reach $23.31B by 2031, growing 20.4% each year. While this is a sizeable market opportunity, companies with close relationships with customers and their data are better positioned to take advantage of it than others.

Why SaaS companies are perfect for embedded lending

SaaS (software as a service) companies are uniquely positioned to offer embedded lending because they have high-quality data about a business’s success and an ongoing relationship. Offering lending products to help customers stay afloat during hard times is in the best interest of SaaS companies because it keeps them as customers and strengthens their relationships.

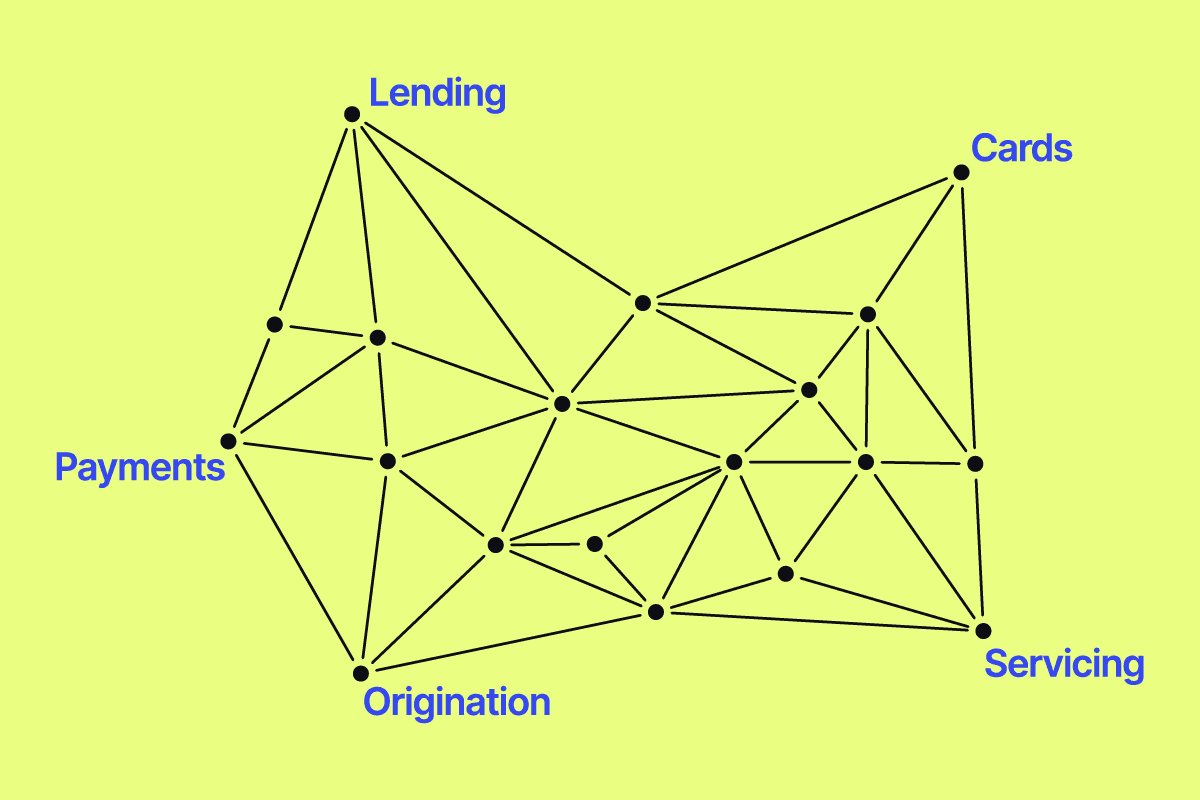

Application programming interfaces (APIs) allow SaaS companies to integrate embedded lending products into their platforms easily. They can seamlessly offer financial help to customers through working capital loans, installment loans, or revolving credit. Because of their relationship and data visibility, SaaS platforms can offer these products when their customers need them most.

Real-world embedded lending examples and opportunities

SaaS companies typically operate under two models: vertical and horizontal. Vertical SaaS is deeply integrated into one industry (e.g., barbershops), while horizontal is integrated with one business function (e.g., accounting). Because they serve their customers in meaningful ways, both types of SaaS companies have used embedded lending to create successful new lines of business.

Horizontal SaaS

These providers either have rich data on one or more business segments or, in the case of an enterprise resource planning (ERP) platform, are a business’s operating system. The opportunities for lending span multiple industries and use cases; instead, they often focus on the type of business.

Flexport, a supply chain logistics company, offers a compelling horizontal SaaS case study for embedded lending. Any company that needs shipping and logistics can use Flexport. However, most companies don’t collect invoice payments before shipping products. Payment terms are often Net 30-90, meaning they don’t get paid for 30-90 days.

After receiving a large international order, a Flexport customer might need extra capital to cover the shipping costs before the invoice gets paid. That’s where Flexport’s embedded lending product, Flexport Capital, comes in. By offering up to 80% of a commercial invoice as a cash advance, Flexport helps its customers cover shipping costs or divert funds to other vital areas.

This product helps Flexport’s customers stay in and grow their business, which means more repeat business for Flexport. It also evolves its customer relationships from vendor to long-term growth partner.

Vertical SaaS

Vertical SaaS providers are deeply entrenched in a single industry. They’re often the focal point of operations for many companies in industries like restaurants, e-commerce, or facilities management. This position gives them rich insights into their customers’ success and when they might need financial support.

Toast, the restaurant point-of-sale (POS) operations system, uses its insights into customer cash flow to assess risk and timing for offering working capital loans. Its embedded lending product, Toast Capital, helps restaurants that operate on thin profit margins cover costs when cash is tight. Toast uses its data to proactively reach out when a restaurant might need a short-term loan and can deliver funds within one business day.

Another vertical SaaS example, ServiceTitan, is an administrative software for contractors in plumbing, electrical, HVAC, roofing, and other trades. Many of these contractors service customers who are surprised by enormous bills, such as the cost of replacing a broken garage door. Many don’t have the funds to make repairs and need to take out a loan.

ServiceTitan enables its contractors to offer loans to their customers through its embedded lending customer financing software. The software integrates into their customers’ business and helps them close more jobs at higher rates. When they can offer a loan through ServiceTitan, contractors see an average of 39% YoY growth and 16% higher average ticket sizes.

Not only is ServiceTitan increasing revenue by generating interest rate income on loans, but it’s also helping contractors grow their businesses and assisting homeowners in getting the much-needed repairs they need.

How to offer embedded lending to your existing customers

Whether you’re a horizontal or vertical company, your unique customer data puts you in an excellent position to offer embedded lending services. Most companies that provide embedded lending do so through banking and servicing partnerships.

For most lending products, you will need capital and a financial institution to help you create lines of credit. However, a traditional bank might not understand your unique relationship with customers. They also might not provide the flexibility you want to give customers with payments to get through industry headwinds and help them stay afloat.

Partnering with an embedded lending platform like Canopy is better than a bank alone. You can work with our team to own and operate your loans, help your customers grow their businesses, and generate more revenue through lending. While Canopy doesn’t offer banking, we can help you access a debt facility and have an integrated network of banking providers ready to help you get started with excellent terms ASAP.

Types of embedded lending you can offer through Canopy

When working with SaaS companies for embedded lending, we usually see them offering the following types of loans.

Working capital: Short-term loans that help customers cover day-to-day operational expenses such as inventory, payroll, rent, or other immediate expenses.

Installment loans: Larger loans with special interest rates and repayment terms that can help customers grow their business, hire more employees, or expand to a new location.

B2B buy now pay later (BNPL): Loans offered for direct sales that make it easier for your customer to purchase things like equipment, machinery, or software. You can save 10-15% on fees by offering these in-house.

These are just a few examples of the types of embedded lending you can offer. You can also get creative to best serve the needs of your unique industry and customers. With Canopy, you can quickly experiment in new areas by building and testing additional loan products.

Help your customers, protect your industry, and grow your business

Embedded lending creates multiple wins. Customers win by gaining access to capital when they need it most. SaaS companies win by creating new revenue streams. Industries win because flexible lending terms enable customers to endure hard times and keep the industry alive.

Interested in building your own embedded lending fintech products? Reach out to our team to learn more about what an embedded lending partnership looks like.