No matter who you are, at some point in your life, you’re likely to turn to one specific financial product to help you attain an immediate need: loans.

Going to school, starting a new business, purchasing your first home, buying a car or a BNPL loan to help you pay off an expensive home project (or that splurge item you just couldn’t live without), it’s a product that’s nearly impossible to avoid.

At the heart of all these items is something that’s deeply personal to you, whether that’s where or how you live, keeping your business running smoothly, or helping a child or loved one attain the college experience of their dreams.

Personalization, please.

So how is it that the loan experience has always been so, well, impersonal? Surprisingly, it has less to do with a lack of desire from banks to create a better experience for their borrowers. More so, it’s because it’s incredibly difficult to create a personalized, transparent lending experience – especially at scale.

This is a big reason why so many fintechs have stepped up in recent years. There are now personalized ways to build credit through MoneyLion, or give rewards to first time homebuyers through Gravy. And we’d be remiss not to mention the massive rise of BNPL companies such as Affirm and Klarna, with 46% of Americans saying they’ve used one of the loans — up from 43% a year ago.

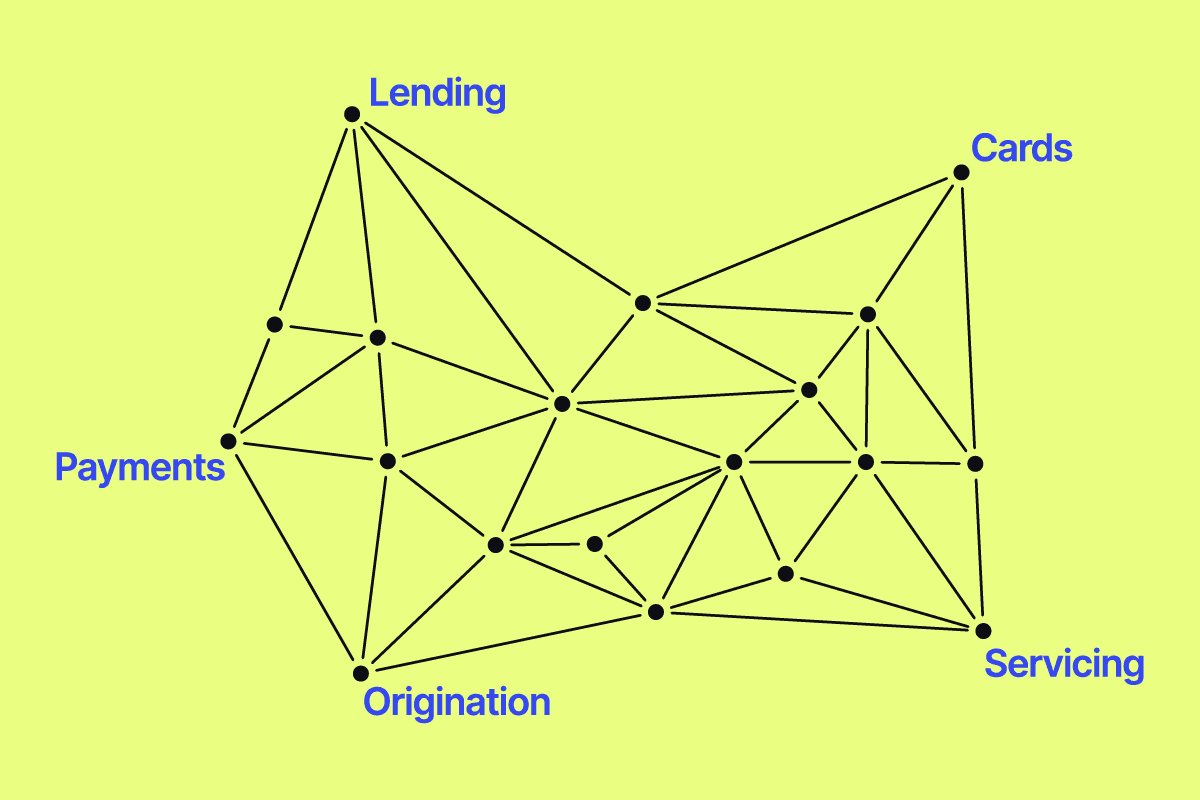

With this growing number of fintechs, challenger banks, and businesses seizing their opening to do better by borrowers and offer more options, it’s important to get a grasp of the full loan management lifecycle and experience, from origination to charge-off. This is where your loan servicing experience is critically important.

Here, we’ve broken down the loan servicing platform “must-haves”, as told by clients, industry experts, and those who have attempted to go it alone with an in-house system. The goal of this guide is to give you an overview of what a loan servicing platform is, and what to look for when trying to find a provider. Whether you choose to work with Canopy or a different loan servicing partner, these are areas that you should be digging into while doing your research.

What is a loan servicing platform?

Let’s start out by answering the question of what a loan servicing platform is. This is a software solution or system that’s designed to manage and automate various aspects of the loan servicing process. It’s often used by lenders, financial institutions, and loan servicing companies to handle tasks such as administration, tracking, and maintenance of loans throughout their lifecycle.

There’s a lot that goes into a single loan. Collecting payments, managing escrow accounts, handling customer inquiries and requests, generating statements and reports, and ensuring compliance with regulations. Having to do all of that manually is a huge commitment for both time and capital. A loan servicing platform can streamline these tasks and offer a centralized system for efficient loan management.

What should you look for?

That brings us to the question of what you should be looking for in a loan servicing provider. Some of the key features to watch for include:

-

Payments: The platform handles loan payments, calculates interest and principal, applies payments to the correct accounts, and generates payment schedules. Whether you’re lending to consumers or to businesses, offering revolving credit or debit cards, BNPL, installment loans, or lines of credit, make sure your loan servicing platform is equipped to handle and accurately calculate all formulas.

-

Customer Communication: Being able to communicate basic information between the lender/servicer and borrowers can save a lot of time. Think of this enabling the exchange of information and updates on loan status, payment reminders, and other relevant communications. For instance, Canopy uses webhooks that can be leveraged to automate nearly every aspect of your customer’s loan lifecycle or your internal team’s unique support workflows such as sending reminders when a payment is due.

-

Account Administration: The system should maintain borrower account information, track loan balances, manage loan modifications, handle loan payoffs, and generate reports on loan performance. An immutable database tracks every change to your ledger, supports real-time calculations, and enables dynamic retroactive events.

-

Compliance and Reporting: This is extremely important in all things financial services. Make sure the platform helps ensure compliance with regulatory requirements and generates reports necessary for audits, financial statements, and regulatory filings. At Canopy, we reduce compliance risk with automations and an immutable ledger that can play back all events in the account life cycle.

-

Document Management: A platform that can provide a secure repository for loan-related documents can be extremely helpful. Think contracts, disclosures, and borrower correspondence. You should always be able to safeguard data in a secure, immutable database with comprehensive compliance certifications and attestations, including PCI DSS and SOC 2 Type 2.

-

Integration Capabilities: Of course, how easy and quickly you’re able to integrate with a loan servicing platform should be one of the top priorities. On top of that, it’s helpful if your loan servicing platform can also easily integrate with other systems you might use such as accounting software, credit reporting agencies, and document signing platforms. Canopy clients easily integrate with top providers such as Visa, Plaid, Mastercard, Marqeta, Galileo, and more.

-

Escrow Management: The system tracks and manages funds held in escrow for taxes, insurance, and other related expenses, ensuring timely disbursements and proper accounting.

-

Supports Growth Plans: If you plan to one day expand from a charge card to revolving credit, or want to add commercial lending to your consumer-only offerings, be sure your loan servicing platform is able to grow with you. Some of our clients have switched from their own LMS or migrated from one that could support them once upon a time. Keep in mind your ability to scale, and don’t be afraid to check your servicing provider on your list of long-term requirements before making a decision.

-

Customer Experience: The final thing to keep in mind is ensuring the customer experience matches the expectations you set during onboarding. For instance, if onboarding is fully digital, but you can only pay by mail, that’s not a great user experience. More on that here.

With a consistent experience throughout the application and duration of the loan, not only will your customers be more satisfied, but you’ll improve operational efficiency and reduce errors, all while staying compliant.

Want to learn more? Reach out to hear how Canopy empowers a better borrower experience through next-gen credit and lending products.