Commercial lending is critical to the heartbeat of most successful businesses. So why is the system which powers B2B lending often taken for granted?

From SMBs seeking short-term financing, to large corporations in need of long-term capital, commercial (or B2B) lending keeps the economic wheels turning by providing necessary funds to grow and expand daily operations.

If the past three years have taught us anything about keeping businesses running smoothly, it’s that commercial lending and working capital are ripe for an overhaul.

For now though, there remains a range of challenges for lenders to successfully navigate, from the creditworthiness of business borrowers to the legal and regulatory requirements of issuing a loan.

In this post, we’ll explore:

-

The complexities of B2B lending

-

Understanding creditworthiness, common loan structures and terms

-

Legal and compliance considerations in lending

-

Effective communication and automation in lending

The Complexities of B2B Lending

B2B lending is a complex process that requires careful consideration of a wide range of factors including borrower needs, regulatory requirements, and internal operations. Lenders need a deep understanding of their borrowers and the financial landscape in which they operate to make informed lending decisions.

Mitigating risk and finding a deal that works well for all is no easy task. Consider the following complexities of B2B lending, each of which must be appropriately navigated before a loan can be finalized.

Creditworthiness of Businesses

Traditional credit scoring models, which rely heavily on an individual’s credit history and credit score, are not sufficient in B2B lending. Instead, commercial lenders should consider the financial health of the business when issuing a loan. Your commercial borrower’s financial statements, such as its income statement, balance sheet, and cash flow statement, can paint you a much clearer picture of its revenue, profitability, and ability to repay the loan.

Other factors, such as the industry and market trends are also worth considering in your scoring model. If, for instance, the borrower is in an industry that is highly cyclical or volatile such as agriculture or construction, you may be taking on a higher risk. You can also weigh the borrower’s reputation and track record, such as its history of paying debts on time.

Types of Loan Structures and Common Terms

Unlike consumer lending, where the loan amount and repayment terms are fairly standardized, B2B lending often involves more complex financing structures.

One of the most common B2B lending structures is a line of credit, which is a flexible financing arrangement that allows the borrower to access funds as needed. A line of credit may be revolving or installment-based, and can be particularly useful for businesses operating with irregular cashflow.

When Should You Issue an Installment-Based Loan vs. Revolving Line of Credit?

When contemplating whether to issue an installment loan versus a revolving line of credit, lenders should consider the borrower’s need, their creditworthiness, and the purpose of the loan.

Installment loans are generally better for one-time, larger expenses with a set cost, such as an office renovation or an asset purchase. They come with fixed interest rates and a set repayment schedule, offering predictability for both the lender and borrower.

On the other hand, a revolving line of credit, like a credit card or home equity line of credit, provides flexibility for borrowers who need ongoing access to funds, up to a certain limit, for fluctuating expenses or for emergencies. The interest rates are typically variable and the repayment schedule is more flexible. The decision should take into account the borrower’s financial stability, ability to manage revolving credit, and their requirement for either a lump sum or flexible borrowing.

Lines of credit can serve as working capital to fund ongoing operations. However, lines of credit can be risky for lenders, as the commercial borrower may not have collateral to secure the loan.

Other loan types include factoring loans, asset based lending, and merchant cash advances.

Factoring Loans

Factoring is another financing structure used in B2B lending. With factoring, the borrower sells its accounts receivable to a third-party in exchange for immediate access to capital. The borrower often pays interest that is dependent on how quickly end-customers pay their invoices. This can be a useful option for businesses that need a quick cash infusion or in the event that a business is not able to borrow via traditional lending.

Asset Based Lending

Asset-based lending is another option that involves securing the loan with specific collateral. This can include tangible items, such as accounts receivable, inventory, or equipment. This type of financing is often used for businesses with high asset value but limited cash flow, such as trucking. Determining the value of the assets can also create risk in the event of a loan default. In this case, it’s important to consider how much of a hit your business is willing to take in the event your client is unable to pay back the loan.

Merchant Cash Advances

This form of financing is particularly common in industries such as retail and hospitality. Lenders provide businesses with a lump sum in exchange for a percentage of their future sales. Repayment is usually structured as a fixed percentage deducted from daily credit card or debit card sales.

Determining Collateral Requirements

One primary challenge in determining collateral requirements in B2B lending is evaluating the value of the assets being pledged. In some cases, collateral may be in the form of physical assets, such as equipment or real estate. In these cases, it’s best to evaluate the current market value of those assets and ensure they’re properly insured and maintained.

In other cases, collateral may be in the form of intangible assets, such as patents or trademarks. These can be more challenging to value, as their worth may be based on future earning potential. If you’re considering asset-based lending products, you should first work with experts, such as appraisers or intellectual property lawyers, to determine the appropriate value of the collateral.

You should also ensure that your commercial borrower’s assets are in good condition and not subject to any prior claims or liens.

A word of caution for small business lenders: an asset based approach can be time-consuming and slow down funding.

Legal and Compliance Issues

Legal and loan compliance issues that arise after loan origination, also known as post-closing compliance, are an essential aspect of the lending process. They are designed to ensure that the lender and borrower meet their obligations as agreed in the loan contract while also adhering to the law.

Here are some key legal and compliance issues to consider once a loan has been issued:

-

Loan Servicing: Loan servicing involves managing and administering loan repayments. It includes billing the borrower, collecting payments, maintaining payment records, and dealing with issues like delinquencies and defaults. Lenders must comply with federal laws such as the Real Estate Settlement Procedures Act (RESPA) that sets standards for servicing loans.

-

Disclosures: Even after a loan is originated, lenders may need to provide disclosures to borrowers. For example, under the Truth in Lending Act (TILA), lenders must provide annual percentage rate (APR) calculations and other key loan terms to borrowers. Any changes to these terms may require additional disclosures.

-

Privacy Regulations: Lenders must comply with privacy laws such as the Gramm-Leach-Bliley Act (GLBA), which mandates that financial institutions protect the security and confidentiality of their customers’ nonpublic personal information.

-

Fair Lending and Anti-Discrimination: Laws such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act (FHA) prohibit lenders from discriminating against borrowers based on factors like race, color, religion, sex, or national origin. Lenders must ensure fair practices in loan servicing and collections, and not disproportionately impact protected classes.

-

Default and Foreclosure: In the event of a borrower default, lenders must adhere to laws related to collections, foreclosure, and repossession. For instance, the Fair Debt Collection Practices Act (FDCPA) prohibits certain methods of debt collection, and various state laws govern the foreclosure process.

-

Reporting Requirements: Lenders must adhere to reporting requirements, such as those mandated by the Home Mortgage Disclosure Act (HMDA), which requires certain information about a loan to be reported to regulatory agencies.

-

Handling of Escrow Funds: If the lender manages an escrow account for the borrower (for example, to pay taxes and insurance), there are specific rules about how these funds should be handled. This includes providing annual statements to the borrower and not charging excessive amounts.

-

Bank Secrecy Act/Anti-Money Laundering (BSA/AML): Lenders need to comply with these regulations to prevent money laundering and other illegal financial activities. This involves having robust systems in place for identifying and reporting suspicious transactions.

-

Bankruptcy Laws: If a borrower files for bankruptcy, the lender will need to follow specific procedures and rules that govern the treatment of the loan in bankruptcy proceedings.

-

Consumer Financial Protection Bureau (CFPB) Regulations: The CFPB issues and enforces several regulations that impact post-loan origination activities, such as rules about debt collection practices and handling customer complaints.

-

State-Specific Regulations: Each state may have its own set of laws and regulations that govern loan servicing, foreclosure, debt collection, and other post-loan origination activities. Lenders must ensure they are in compliance with these laws.

To maintain legal and regulatory compliance after loan origination, it’s key to stand up an effective loan servicing system. A reliable loan servicing system should have robust software that can handle loan origination, payment processing, account management, reporting, and other necessary functions. The software should be flexible, scalable, and capable of integrating with other systems to ensure smooth operations.

It’s also beneficial to have policies and procedures in place to handle borrower complaints and disputes. The penalties for non-compliance can be severe, including fines, lawsuits, and damage to the lender’s reputation.

The Role of Effective Communication and Automation in Lending

Effective communication is crucial in B2B lending, as it enables you to understand your borrowers’ needs, capabilities, and risk profiles.

Communication Between Lenders and Borrowers

The communication begins during the loan application process, where lenders must work with borrowers to gather relevant information and assess the borrower’s creditworthiness.

Communication between the lender and borrower remains important throughout the life of the loan. Borrowers should have a clear understanding of their obligations under the loan agreement, including repayment terms, interest rates, and any fees or penalties associated with the loan.

Effective communication is also important in addressing any issues or concerns that may arise during the life of the loan. Borrowers should feel comfortable reaching out to their lender if they are experiencing financial difficulties or if they have questions about their loan. In turn, as a lender your team should be responsive to these concerns and help find solutions that are mutually beneficial.

Addressing Hardships in B2B Lending

In the case a business is struggling to pay back their loan according to the terms agreed upon, your loan management system should give you (and your borrower) options. For instance:

-

Issue an extended grace period or waive late fees for a set period of time

-

Offset the interest, principal, or fees

-

Update the credit limit to account for your borrowers’ needs

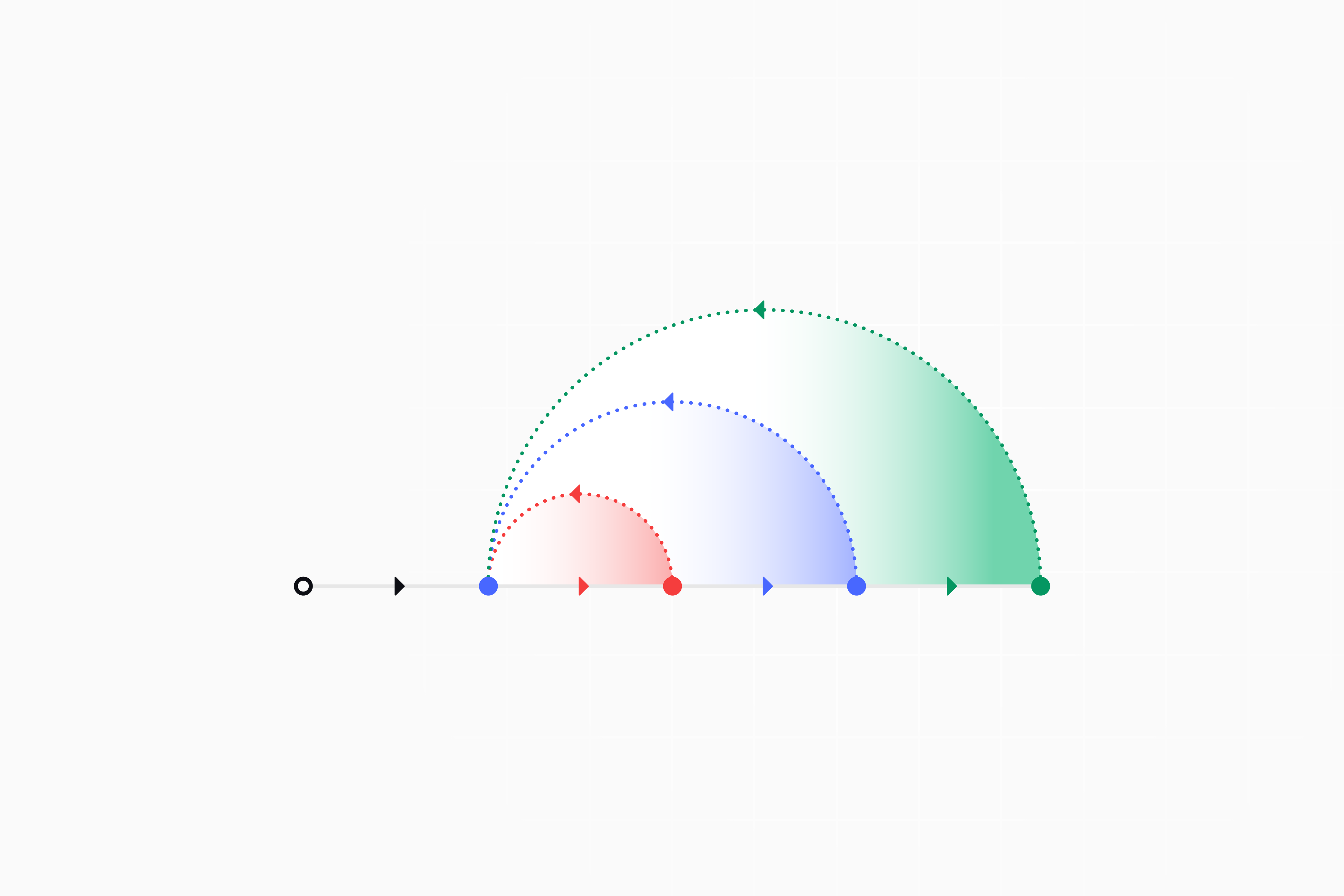

Webhooks can also be used to automate these types of actions, depending on the flexibility of your loan management system. Canopy’s LoanLab can also help you simulate scenarios and preview what would happen if certain actions took place.

Internal Communication Within the Lending Organization

Internal communication within your organization is crucial for efficiently processing loan applications. It requires all teams to be on the same page, including loan officers, underwriters, credit analysts, and back-office support staff.

When workflows and norms are in sync with your borrowers’ expectations and needs, the entire loan team is able to work efficiently and effectively. Even better, borrowers feel well-supported, which makes for better long-term business relationships. This involves ensuring that loan officers and underwriters are communicating regularly to exchange information and discuss loan applications. Underwriters must communicate any issues or concerns they identify during the review process with loan officers, who can then work with borrowers to address these issues.

Clear timelines and deadlines for each step of the loan application process can also speed up the loan origination. Regular monitoring and tracking of loan applications can identify potential roadblocks or issues early.

Communication with Regulatory Bodies

Transparency and clarity in communication are key when dealing with regulatory bodies. This involves providing accurate and timely information to regulators, responding promptly to inquiries, and addressing any concerns or issues raised by regulators in a timely and appropriate manner.

It is also important to establish clear communication channels and processes to ensure that information is flowing smoothly between the lending organization and regulatory bodies.

The Role of Automation in B2B Lending

Automation can also play a crucial role in streamlining the lending process, reducing costs, and minimizing errors. By automating routine tasks such as data entry and document processing, lenders can free up staff to focus on more complex and value-added tasks such as credit analysis and relationship management.

Automation can also help to ensure consistency and accuracy in loan processing and documentation, reducing the risk of errors and omissions that could lead to compliance issues.

In addition to improving efficiency and reducing costs, automation can also help lenders to better manage risk by providing real-time data and analytics. This can assist lenders in identifying potential issues and taking corrective action before they become larger problems.

Become a Master Operator of Your B2B Lending Program

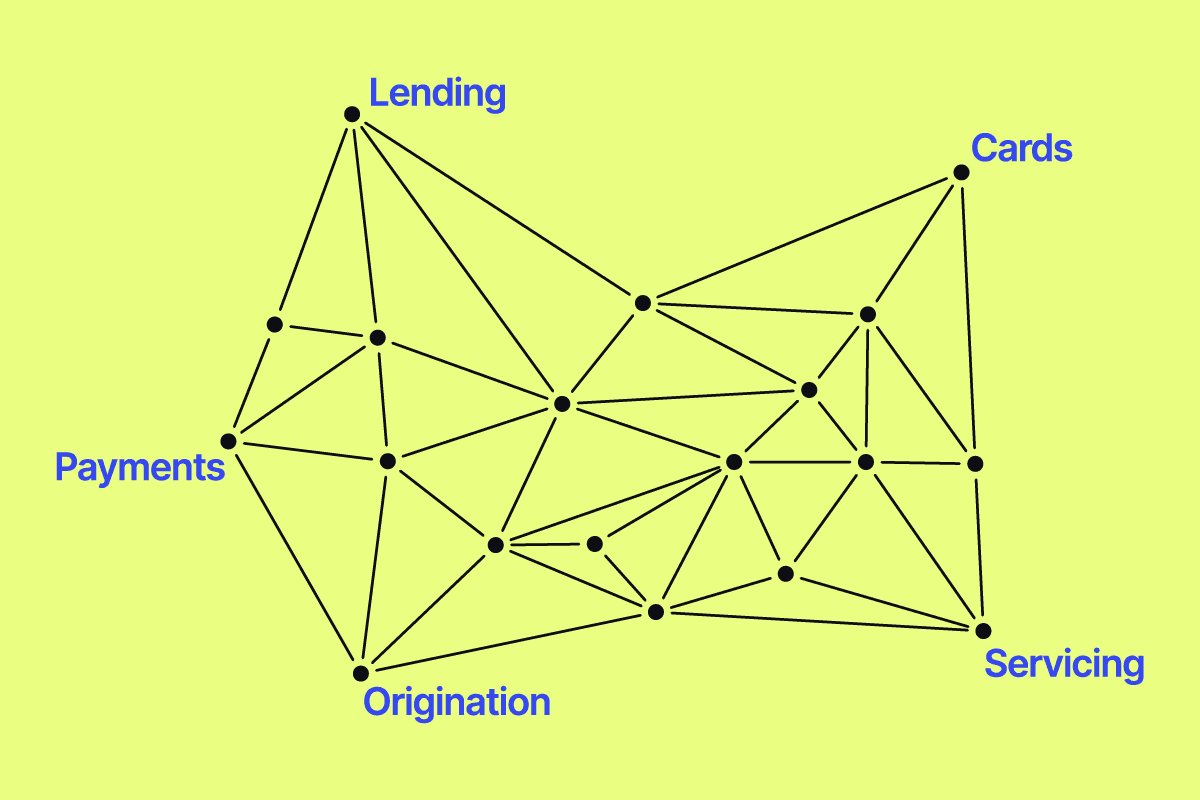

B2B lending can be a complex and challenging process, but Canopy is here to help. If your team is spending too much time and energy servicing its loans, get in touch with one of our specialists. Our robust network of powerful connectors can help power your lending ecosystem, while Canopy sits at the heart as your system of record.

About Canopy

Canopy is a modern platform for managing and servicing loans. Our flexible, API-first architecture ensures any brand can embed financial products, bring those products to market quickly, and support borrowers with world-class service in a highly secure and compliant way.

Fintechs, banks, and credit unions use Canopy to improve borrower repayment rates, increase net promoter scores, and decrease the cost of servicing for lending and credit card products.

Highly reliable and flexible, Canopy’s immutable ledger supports custom product constructs and enables unique features such as the ability to modify accounts in real time, create multiple policies for accounts, and retrieve the results of real-time or retroactive calculations.

At the same time, automations set your agents up for success, and our partner ecosystem offers no-code/low-code integrations so you can launch with fewer developer resources.

Launch Your Next Lending or Credit Product on Canopy Learn More