In the evolving landscape of financial products, the launch of new lending initiatives has become a pivotal strategy for many commercial lenders. In a recent webinar that we hosted, Justin Sherlock, former head of capital at Flexport, shed light on the motivations driving this trend and the intricacies involved in navigating it successfully.

The Financial Landscape: Trends and Motivations

Justin initiated our discussion with a notable statistic: over half of commercial lenders are currently preparing to roll out new products. This significant trend is largely driven by the growing interest in embedded fintech and the development of bespoke financial solutions for businesses. Though, at the heart of this movement is the potential for substantial profit margins, with firms increasingly focusing on effectively monetizing their existing data and transactional activities.

Justin also emphasized two crucial advantages of introducing lending products beyond pure financial returns. The first is the deepening of stakeholder engagement, which fosters a transformative change in customer relationships. The second advantage involves broadening the scope for partnerships, enhancing customer wallet share, and creating opportunities for cross-selling. These factors collectively contribute to a fundamental shift in the dynamics of client interactions.

A central point Justin brought up was the pivotal role of data. For the successful launch of financial products, having access to unique and insightful data is key. This data is instrumental not only in fine-tuning customer targeting and acquisition strategies but also acts as a vital strategic asset in the effective deployment of these financial products.

Challenges and Learnings from Flexport

Reflecting on his past experiences, Justin discussed the challenges Flexport faced while developing their lending division, Flexport Capital. For example, he detailed how the initial stages were characterized by a somewhat scrappy backend system. Initially, the company managed its loan ledger using Salesforce, before moving to a custom-built tool and ultimately transitioning to Canopy. In hindsight, Justin realized that partnering with a technology provider from the beginning might have streamlined their ledger management and enhanced their reporting capabilities.

Looking back, Justin is an advocate for a resourceful and adaptable approach in the early phase of product development. However, he also emphasizes the need to lay a strong and sustainable foundation for long-term success. The conversation with Justin shed light on the strategic considerations, obstacles, and valuable lessons learned in the journey of introducing financial lending products.

The Role of Ledgers in Launching New Products

The discussion also dove into the crucial role ledgers play in launching financial products, with insights from Flexport Capital’s experience. It highlighted the need for flexible ledger systems to meet the dynamic demands of financial services and to tailor products to customer needs effectively.

Flexport Capital’s venture into deposit financing exemplifies this approach, demonstrating their ability to spot market needs and adapt quickly with a flexible system, notably through their collaboration with Canopy. This agility contributed to significant revenue in the first month of operation. Justin also noted a broader trend: commercial lenders are increasingly innovating due to traditional banks’ inability to meet specific market segments’ needs, emphasizing the importance of personalized commercial lending solutions.

Strategic Timing in Launching Financial Products

Next, we tackled an essential topic – the timing of integrating financing into product strategies. Justin, once again drawing from Flexport Capital’s experiences, sparked a fascinating debate. Should financing be a foundational element of a product from the start, or should it be introduced later as a way to monetize? At Flexport, the choice to launch financing offerings was closely intertwined with the volume of inventory flowing through their system.

The discussion then shifted to a key strategic dilemma: whether to lead with financing as a means to gain customers, or to focus on monetization to enhance underwriting. Justin observed that while initially leading with financing can be advantageous for acquisition, it may lack the underwriting robustness that comes from established platform data and transaction volumes.

Strategic Alignment and Signals for Launching Lending Products

We then dove into the vital role of strategic alignment when incorporating lending into a business model. The talk made a clear distinction: Is lending being used to boost revenue within an existing market segment, or to move into new ones? The key takeaway was that lending shouldn’t be an afterthought; it needs to be woven seamlessly into the broader business strategy, in sync with management’s vision and company goals.

Justin then steered us towards understanding when it’s the right time to roll out lending products. He highlighted the critical role of customer data and needs. It’s about starting with a clear grasp of the customer’s challenges and figuring out how financing solutions can effectively solve those problems.

We also touched on various indicators for launching lending products, like funding sources, partnership opportunities, customer loyalty, and rewards. Justin’s insights shed light on the strategic considerations and markers that should inform the decision to introduce lending services.

Scaling Challenges and Risk Management

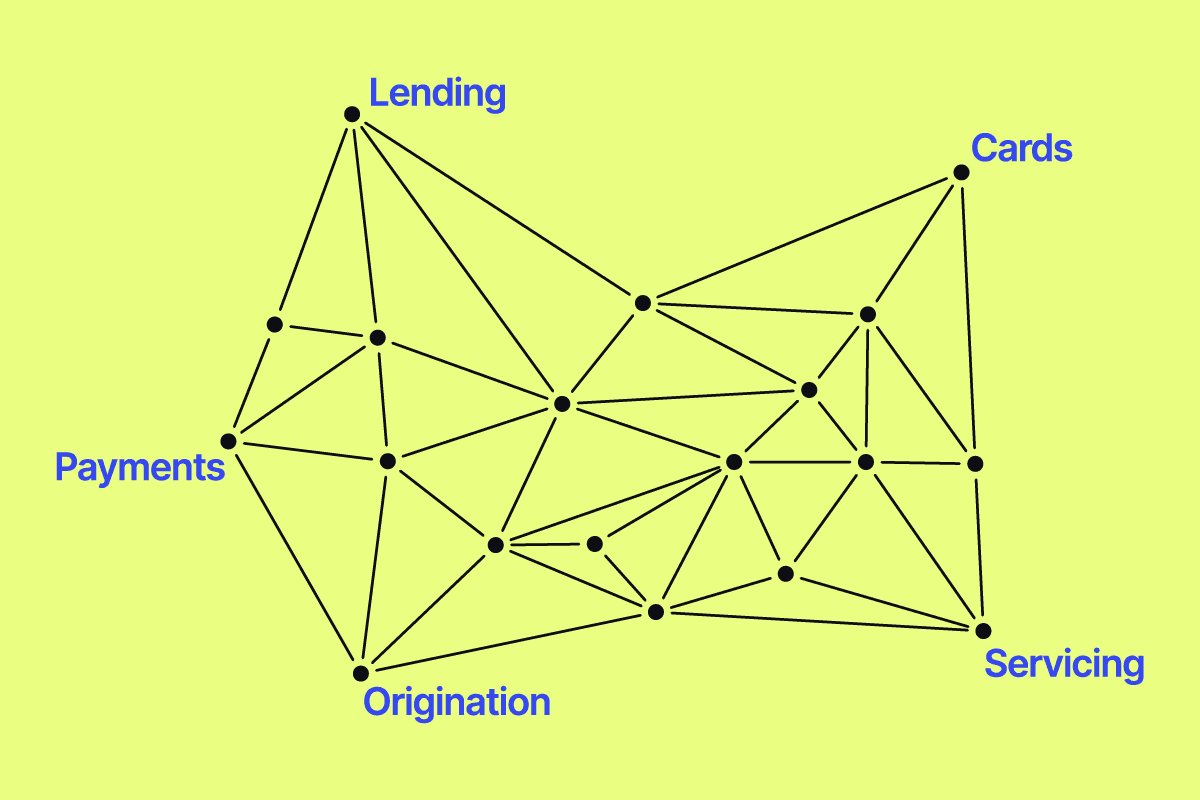

Our discussion then ventured into the complex terrain of scaling lending programs and managing the accompanying risks. We tackled key challenges head-on, discussing solutions across a spectrum of issues like financial reporting, the intricacies of technology, credit monitoring, compliance, and strategizing around data.

Reflecting on his own journey, Justin shared a critical learning – the crucial role of accurate data and reporting. He spoke candidly about the struggles they faced due to multiple ledger changes, which became a roadblock to scalability. This underscored for him the vital need to establish a scalable foundation right from the start.

Adapting to Interest Rate Changes

Lastly, we tackled the topic of how interest rate fluctuations impact the scaling of lending programs. This is especially relevant now, with rates significantly higher than in previous years. We examined various factors, including the pros and cons of fixed versus floating funding costs, developing a pricing strategy, handling delinquencies amidst changing credit cycles, and managing risk during different phases of growth.

The conversation highlighted the necessity for strategic shifts in response to fluctuating interest rates, underlining the significance of effective risk management and the value of cultivating long-standing relationships within the lending industry.

Our webinar provided an in-depth look at the ins and outs of launching, scaling, and adapting financial products. In the ever-evolving world of commercial lending, a sharp grasp of market demands, strategic timing, and efficient risk management is essential. Particularly crucial is the synergy between financial institutions and technology partners, which is key to successfully navigating the complex landscape of introducing commercial lending products.

Have questions for the Canopy team about standing up or optimizing your commercial lending products?

Get in touch: Contact the Canopy team