Embedded lending refers to integrating lending services into a company’s existing products and services, giving customers access to loans within their current ecosystem. But what exactly goes into offering embedded lending? And what are the key benefits for consumers and companies alike?

What is Embedded Lending

We can’t talk about embedded lending without first discussing lending itself.

A loan is a financial arrangement where a lender, such as a bank or financial institution, provides money to a borrower. The borrower agrees to repay the loan amount over a specific period of time, typically with interest or other fees.

Loans can be used for a variety of purposes and can be taken out by individuals or businesses. Think mortgages, auto loans, student loans, and small business loans. The terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral or guarantees required, are usually agreed upon by both parties prior to funding of the loan. The borrower typically has to make regular payments to repay the loan and that is usually a combination of the principal amount borrowed and the accrued interest. The timeline can vary based on the terms of the loan.

Embedded lending involves all of the same players as a typical loan, but it’s integrating the lending process into current product and service offerings.

For instance, a company that started out by offering debit cards to customers may eventually want to expand into credit products. Rather than having to send their customer to another provider for a different type of loan, they could embed a lending offering itself and keep the customer within its own ecosystem. This is becoming increasingly popular given that companies are looking to provide customers with a complete suite of financial services. It also diversifies a company’s revenue stream.

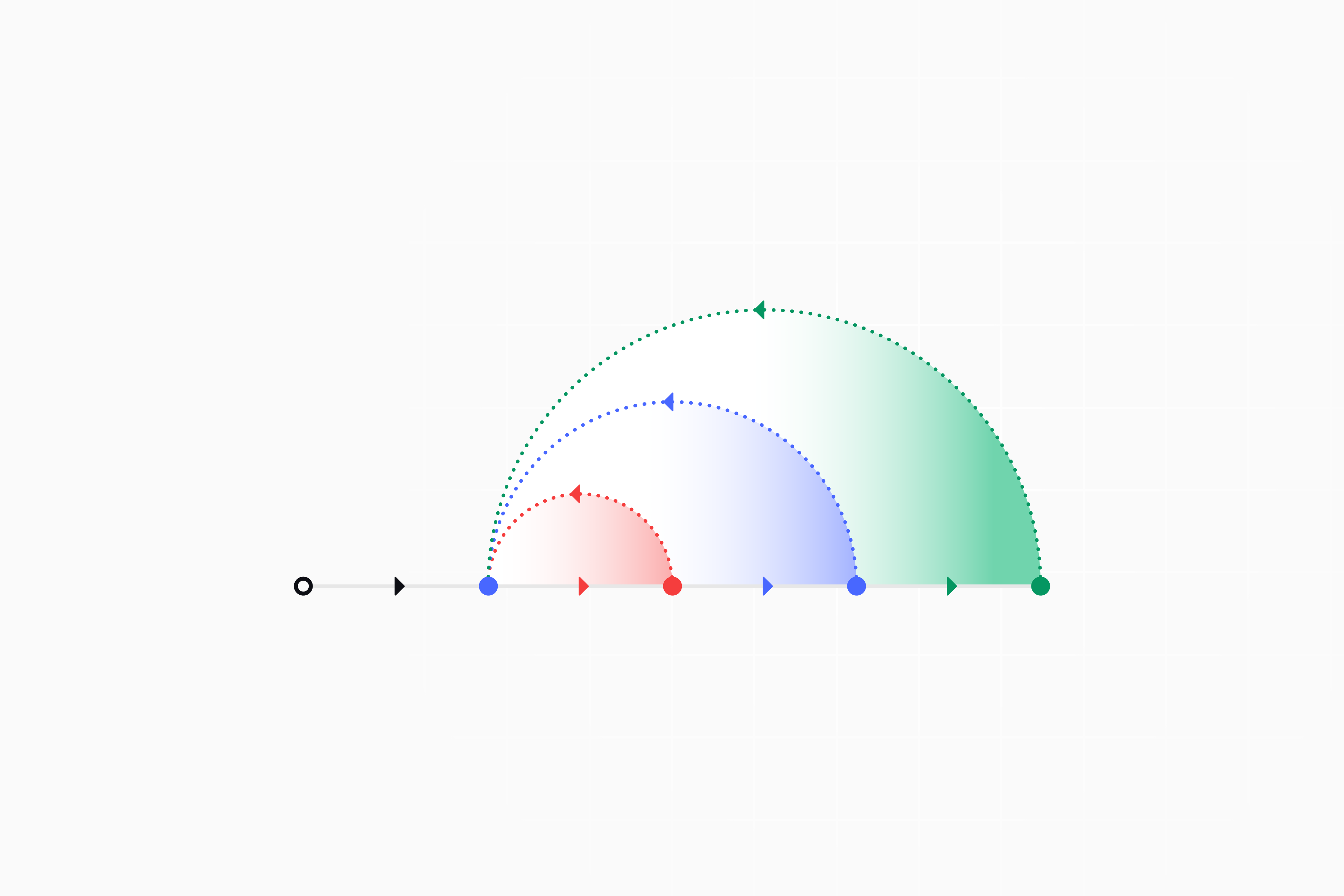

The lending process also takes on a much different form with embedded lending. The loan is typically initiated through the company’s existing platform, and customers can then apply for a loan that’s reviewed and approved within minutes or hours, rather than days or even months in some cases.

Just like loans elsewhere, the type of loan can vary to meet the customer’s needs. Personal loans, business loans, and Buy Now Pay Later can all be offered through embedded lending. Not to mention, rates can still be variable or fixed, the duration of the loan can be short or long, and it can be secured or unsecured.

How Embedded Lending Improves Communication

The enhancements don’t stop when the loan is approved either.

Embedded lending makes it easier for customers to communicate with the financial institution and vice versa. This means customers can easily and quickly receive support and make payments. It also means that the financial institution can easily gather insights on the loan to see delinquencies, check balances, see payment history, and more.

Evolving Ecosystem

This streamlined process is creating new opportunities for consumers and companies alike. In particular, artificial Intelligence and machine learning are playing a big role. Not only are they reducing the time and effort required to process loan applications, but they’re making it so companies can provide customers with tailored loan options, personalized interest rates, and loan terms based on their financial goals and profile.

Take credit data, for instance.

Credit bureaus maintain credit reports for individuals and share that information with lenders, such as banks, credit card companies, and other financial institutions. Without this information, it would be extremely difficult for companies to offer loans without having high risks of default.

With embedded lending, the loan application process is integrated into the customer’s experience and the lender has access to the financial data we mentioned above, meaning the loan approval process is more efficient and leads to smart, fast decisions.

The Benefits

For both customers and financial institutions offering these products, there are a slew of benefits. With embedded lending, companies are able to tailor their offerings to a customer’s specific needs and quickly offer a digital solution, creating a competitive advantage and superior customer experience.

This goes beyond loans for individuals. Businesses taking out loans receive their share of benefits as well, especially small businesses that typically don’t have several lending options. With embedded lending, the types of loans available increase and the time to funding decreases, which can be crucial for those with tight cash flows.

Conclusion

If we were to write a TL;DR, it would be that embedded lending is the integration of lending services into the core offerings of financial institutions and businesses. The lending process still involves evaluating loan applications, conducting credit checks, and determining loan options, but the process is streamlined.

Want to learn more? Reach out to hear how Canopy’s platform enables you to become a world class operator of your lending programs.