Small-to-medium sized businesses across many industries frequently need a small loan to cover daily expenses, but don’t have a reliable option to turn to. While traditional lending can feel inaccessible or too slow for many businesses, newer types of lending can help.

In this article, we’ll discuss working capital lending, which helps businesses cover day-to-day expenses and can be a lifeline during hard times.

Topics covered include:

- The problems small businesses face with typical lending from financial institutions.

- What working capital loans are and how they cover gaps in the traditional lending space.

- Real-world examples of working capital lenders in different industries.

- Why embedded SaaS lenders are perfectly situated to offer working capital loans.

- How to start an integrated working capital lending program.

The problem with small business loans

Small businesses are vital to our economy, creating 55% of total US jobs in the decade from 2013-2023. However, they often struggle to access new capital to create those jobs.

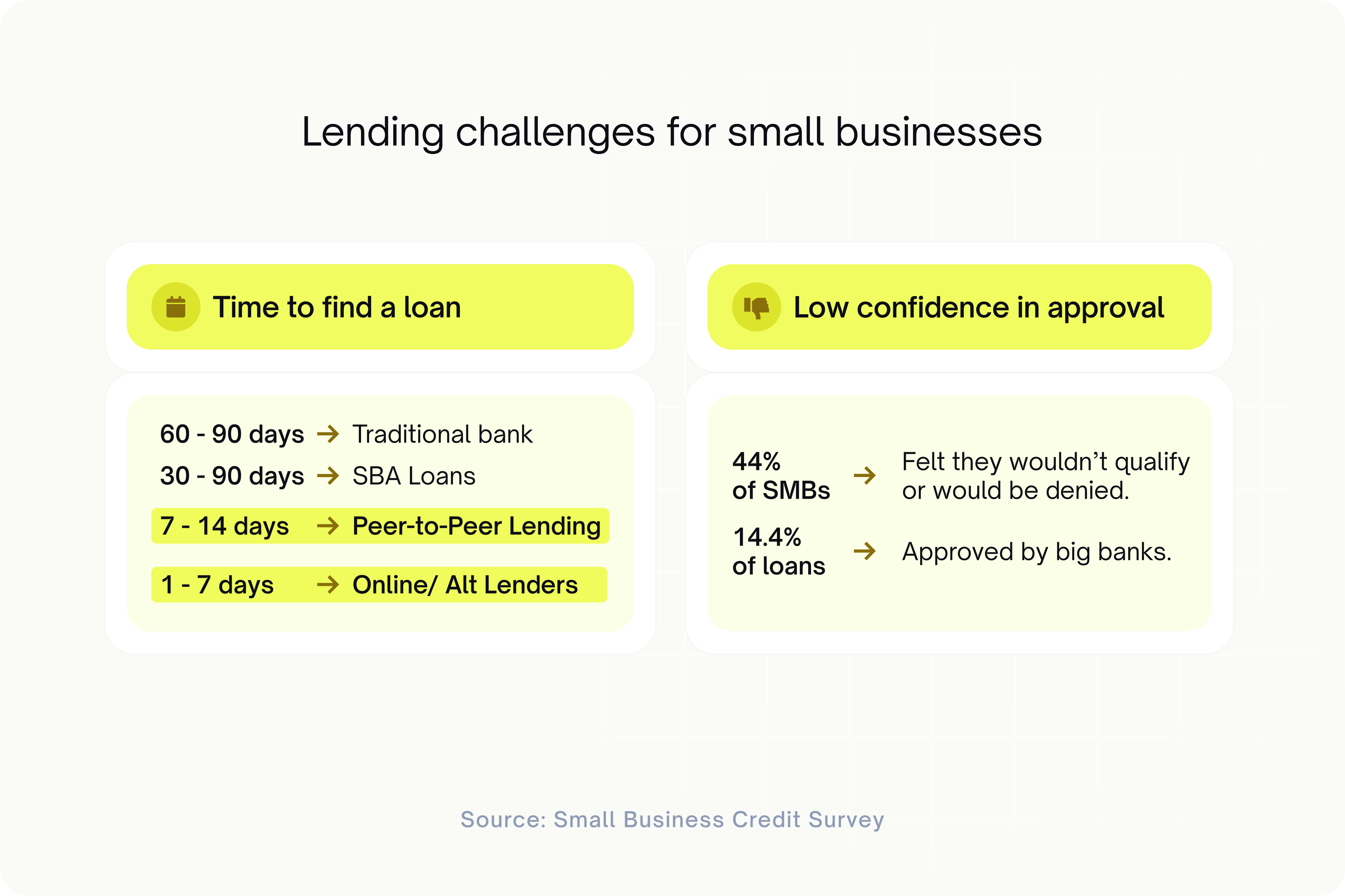

According to the Small Business Credit Survey, only 14.6% of SMB (small to medium business) loans are approved by traditional banks. On top of that, small businesses face high interest rates, long approval waiting periods (especially with traditional banks), and difficulties in finding the right kind of loan with a high enough limit.

Startup and expansion are not the only reasons small businesses take out loans. Many must take out loans to cover day-to-day expenses, especially in industries where invoices are paid with 30- to 90-day terms. A business might have bills, payroll, and other expenses due but is still waiting on a big payment to come in and need a loan to cover those costs. This is also true for industries like restaurants, which can be affected by seasonality and tight profit margins.

Working capital lending is a new type of loan product built to address the lack of fast access to capital and the need to cover day-to-day costs, and it can be a game-changer for small businesses.

What is working capital lending?

Rather than providing capital for starting or expanding a business, working capital lending provides financing for day-to-day operational expenses. Typically reserved for SMBs, these loans can cover payroll, rent, utilities, inventory, or other pressing needs. They often bridge that gap when expenses pile up, but pending payments haven’t been received (like from Net 90 invoices).

Working capital loans typically have a shorter repayment period. They’re also flexible in that amounts can be adjusted, repayment schedules can vary, and interest rates can change based on the borrower, industry, lender, and other factors. They also need to be readily available to small businesses and not take up to 90 days to be paid out like some traditional business loans—as expenses need to get paid ASAP.

These are the typical types of working capital loans:

- A business line of credit that businesses can draw from at any time and then pay back when they’re ready.

- Short-term loans with fixed repayment terms.

- Invoice factoring, which is using an outstanding invoice to qualify for a loan. The customer pays back the loan after they receive payment for the invoice.

Working capital lender examples

Depending on their business type, working capital lenders often serve a horizontal market, such as shipping or enterprise software, or vertical industry, such as restaurants or manufacturing.

Let’s look at an example of each.

Flexport Capital

Flexport Capital is a horizontal SaaS providing working capital loans to shipping customers across many industries. It gives Flexport customers a credit limit that they can use to finance inventory and logistic costs based on unpaid invoices. Financed invoices are paid back in a fixed term between 60-120 days, and customers can keep a running balance as they finance new invoices and pay off old ones.

Flexport partnered with Canopy to build this working capital lending program, which provides customers with freed-up cash, more runway, and flexible limits. Capital can be accessed quickly and doesn’t require a heavy document load for new loans.

Toast Capital

Toast Capital offers a similar working capital loan program, but it’s a vertical offering specifically for Toast’s customers in the restaurant industry. Customers that use Toast’s point-of-sale (POS) system can take out a loan between $5,000-$50,000 to finance day-to-day expenses such as rent, perishable goods, or payroll. Then, they automatically pay Toast back as payments come out as a fixed percentage of daily card sales.

This provides an easy option for restaurants to quickly gain access to much-needed capital when they need it and a zero-effort way to pay back the loan. Restaurant owners can apply for loans in minutes and get funding the next day.

Other fintech working capital lenders

Not all working capital lenders are software providers serving a specific industry. Several fintech companies, such as BlueVine, FundBox, and Credibly, leverage tools like AI and machine learning to offer fast access to working capital loans. While these companies don’t have as close of a relationship with their customers as the SaaS lenders, it’s still an excellent option for many cash-strapped small businesses.

Why working capital loans are perfect for embedded SaaS lenders

Embedded lenders, like the SaaS companies listed above, are perfectly situated to provide working capital loans to their customers. These companies are deeply integrated into the structure of their customers’ businesses and have a deeper working relationship than typical vendors.

Additionally, they serve a specific segment or industry, so embedded SaaS lenders can help their industries survive when headwinds or downtimes come by offering working capital to those temporarily struggling. This further deepens their trust and loyalty as an essential software vendor.

Because of their close relationship, these embedded SaaS lenders have more opportunities to offer repeat financing than a fintech lender or bank that customers have less daily interaction with.

How to create a working capital lending program

Creating a working capital lending program might require multiple vendors for different pieces of the program, namely:

- Origination

- Payment processing

- Credit reporting and underwriting

- Loan servicing

At Canopy, we provide an intelligent, data-driven solution for the loan servicing side of your program, and we have integrated partners that make it easy for you to create a seamless working capital loan program.

For loan servicing, Canopy provides an intelligent loan operating system that can help you maximize revenue from credit-worthy borrowers and minimize losses from risky ones. We can help you create a flexible program to increase repayment rates and offer new loans to existing customers at the right time.

For everything else, Canopy integrates with origination providers, issuing processors, payment processors, and everything else you need to create an integrated working capital lending program.

Interested in building your own working capital lending program? Talk to us and learn how we can help you build a seamless, integrated program.