Managing collateral with canopy

Built for the future of secured lending.

Single source of truth.

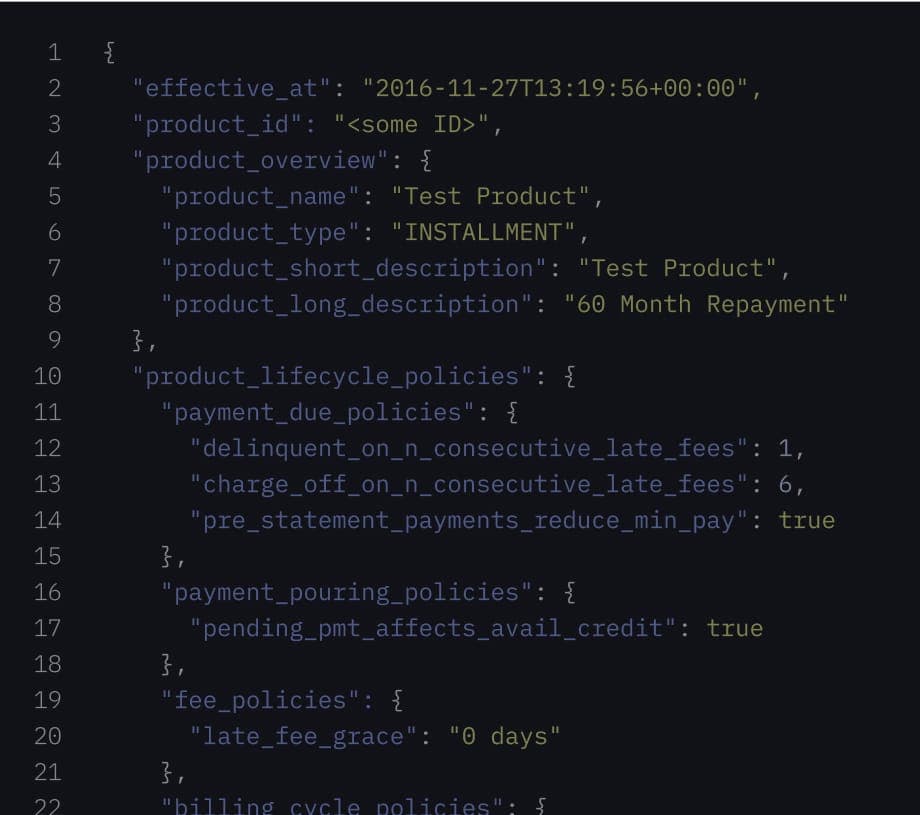

Canopy is your system of record for lending and collateral management. Remove disjointed systems with an audit-ready platform for secured lending. Better manage credit risk and maintain accurate records across every transaction.

Expanded collateral types.

Manage a wide range of collateral types, from traditional assets like real estate & equipment to modern assets like cryptocurrency & collectibles. Create innovative secured lending products that uniquely serve your customers.

Asset-driven insights.

Improve risk management with LTV breach monitoring alerts and automated draw restrictions when in breach. Incorporate senior liens into your LTV calculations to ensure accuracy and risk protection for junior lienholders.

Collateralized assets we support.

Real Estate

Accounts Receivable

Securities

Cash

Automobiles

Inventory

Fine Art & Collectibles

Equipment

Business Assets

Cryptocurrency

Streamline collateral management to ensure accurate LTV ratios.

1. Add collateral to your SOR. This gives you an accurate view of the loan and its collateral, setting the foundation to manage credit risk.

2. Update collateral valuations. This ensures that your LTV ratios always reflect the most current and accurate data.

3. Incorporate senior liens. This adjustment provides a precise LTV calculation, accounting for priority claims on the collateral.

4. View all collateral for a loan. This overview allows you to see all assets tied each individual loan.

5. Monitor LTV compliance. The system monitors LTV ratios and alerts you when a borrower violates compliance thresholds so you can act quickly to address any breaches.

6. Identify asset pledges across loans. This gives you a complete picture of how each asset is leveraged across your portfolio.