Let’s face it, building a credit or lending program is complex.

Whether you’re standing up a new wellness credit card that rewards users over time or issuing a revolving line of credit to a business, there’s zero room for error in your ledger.

That stark reality can be overwhelming, but fear not. We’ve got you covered.

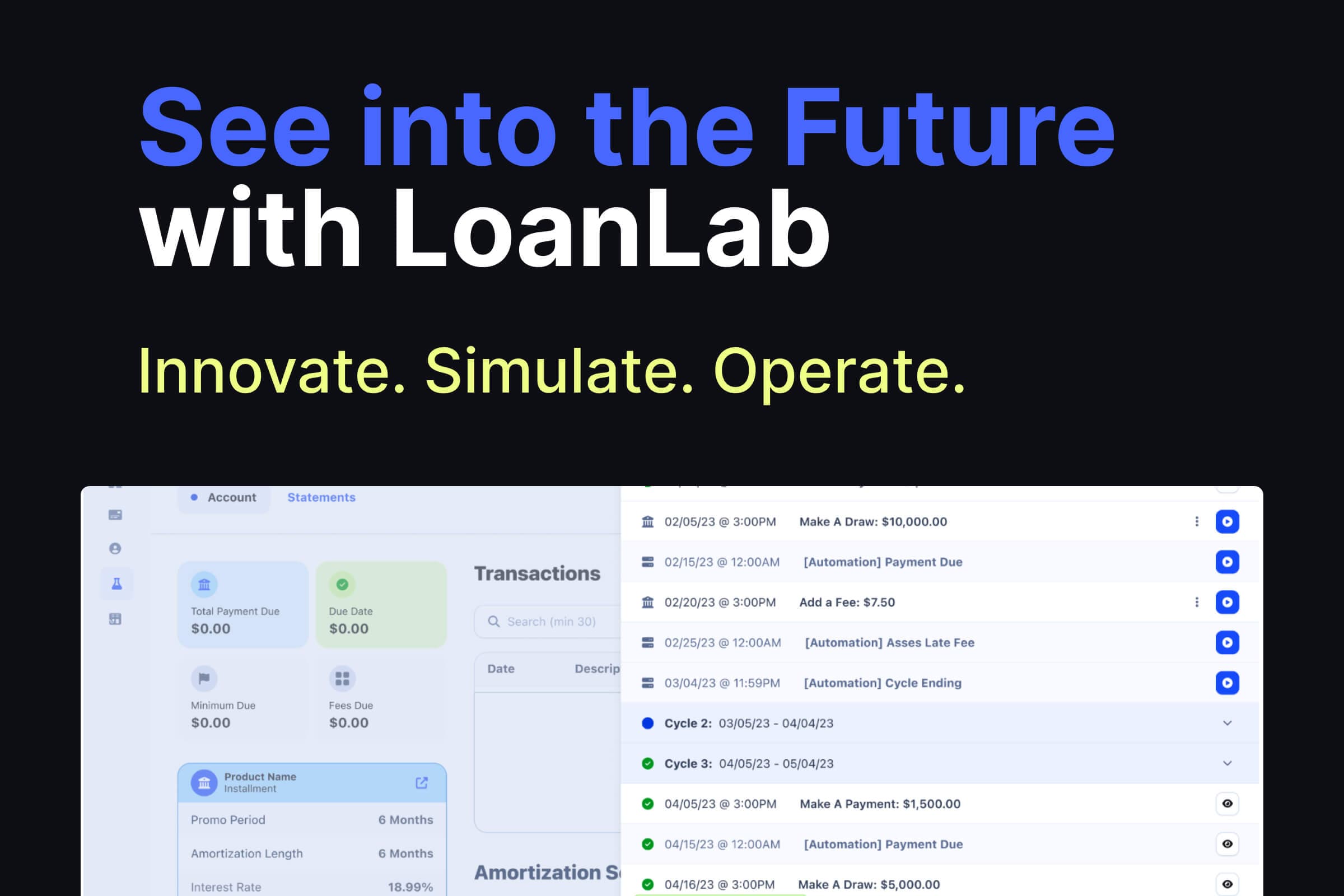

From Loan Origination to Loan Servicing

Once your borrowers move through the loan origination process, they expect the digital servicing experience to be tailored to their preferences and provide clear answers.

To help ensure your lending product is ready for the masses (and free of errors), we’ve developed a simulation environment that enables innovators like you to experiment.

With LoanLab, you can simulate the entire lifecycle of a loan, test different policies and actions, and observe the effects over time.

Here’s How it Works

-

Choose a product within the account. Choose from installment or revolving loan products as your starting place. Then choose your account level policies, including any details for your ideal program, like grace periods or monthly service fees.

-

Create your actions and timeline. Through the timeline, you can set up what you want to happen throughout the account’s lifecycle. This also allows you to simulate scenarios and see what they look like for borrowers and your operations team when certain actions take place.

-

View the account. Finally, get an accurate representation of what you can expect to see from the account perspective by going through the test case scenario in production.

Why Simulate Loan Experiences?

Fintech as a whole is moving into its “lending phase”, as Alex Johnson of Fintech Takes explains in depth here. More unique and personalized options are being served up than ever before to appeal to the growing number of borrowers who prefer non-traditional banking options. It couldn’t be a more fitting moment for fintechs and challenger banks to disrupt the norm and offer differentiated credit and lending products.

At the same time, the bar is still high when it comes to maintaining compliance and borrower expectations – and for good reason.

Ambitious fintechs, neobanks, and powerhouse brands aren’t sleeping on this opportunity. From Apple recently launching its new BNPL product, Apple Pay Later, to Allianz and Bueno.money partnering on a payment solution for eCommerce merchants, it’s a perfect time to disrupt the status quo of traditional banking.

Canopy exists to help lenders innovate faster, with borrower safety and transparency built at the heart of our loan management platform.

Inspired By Lending Trailblazers

Our top priority is to empower lenders to become exceptional operators of their lending program. We noticed a common challenge among our clients when it comes to validating, testing and experimenting with their lending program policies.

LoanLab was born out of empathy for this challenge, as well as our unwavering commitment to transparency and innovation. By providing lenders with the ability to confidently vet our software, experiment with new product constructs and account level policies, and gain valuable insights, we aim to equip them with the tools necessary to stay ahead of the curve and succeed in a constantly evolving industry.

Your Turn to Make an Impact on the Future of Lending

With LoanLab, you get the tools you need to confidently vet your software and experiment with new product constructs and account level policies.

This ultimately leads to better lending practices, which can benefit borrowers in the form of fairer loan terms and more transparent lending practices.